Chart Of Accounts For Nonprofit

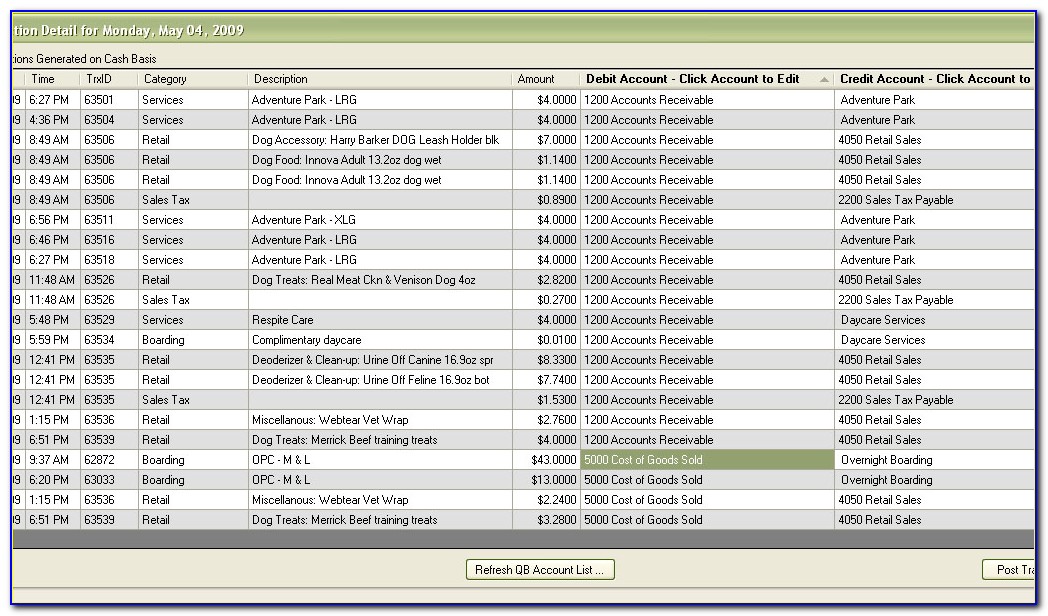

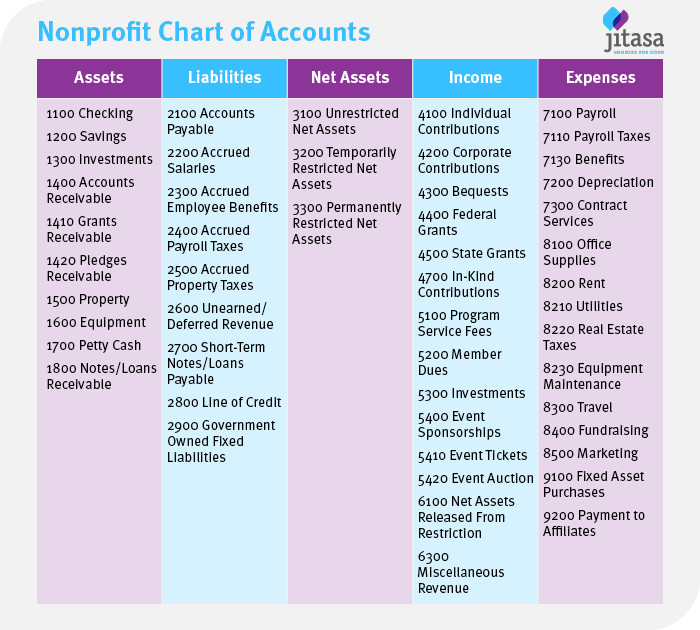

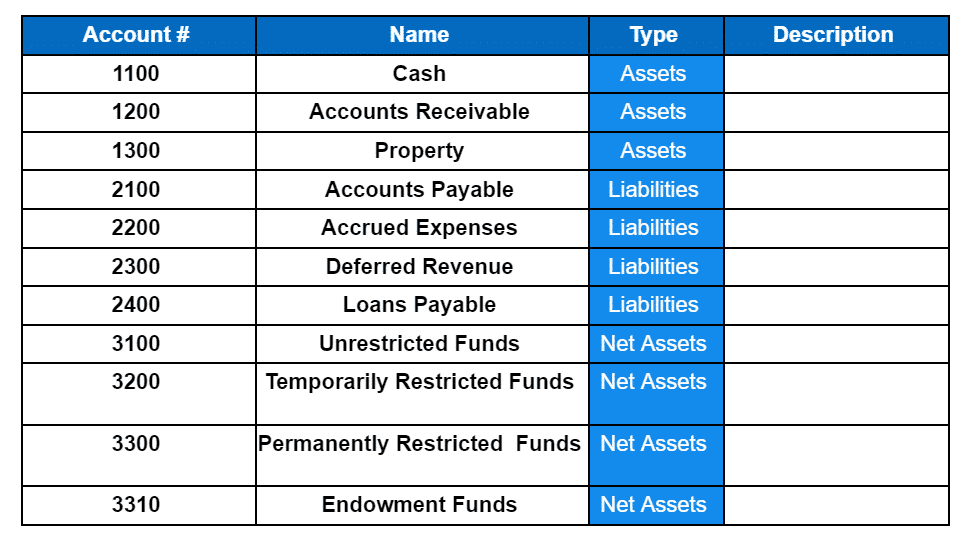

Chart Of Accounts For Nonprofit - Web a chart of accounts is a detailed listing of minor categories under the major categories of assets, liabilities, net assets, revenues, and expenses. What is a nonprofit chart of accounts? Web in this guide, we’ll explore the basics of the nonprofit chart of accounts, including: Let’s dive in with an overview of what your nonprofit’s coa is and how it’s. Because the coa compiles so much information, this important resource can be daunting to create and challenging to keep up with, especially if you don’t fully understand its usefulness.” visit the guide and example. The first step toward building an effective coa is to create a list of what your company will need to account for in the future. Web the nonprofit chart of accounts should be split into statement of financial position and statement of activities sections, each of which is then subdivided into groups (e.g. 30% off clearance itemsprice match availableall the latestfree trial available Track inventorymaximize tax deductionsget tax savingstrack projects In our last post, lists: Structuring a chart of accounts for nonprofit organizations; Number, name, category type, and a short description. Web a non profit chart of accounts is used by a non profit organization, and is a list of the accounts found in the general ledger with an account code allocated to each account. What is a chart of accounts? Track inventorymaximize tax deductionsget tax savingstrack projects These line items pertain to your financial position (or statement of financial position) and to your financial activities (or statement of activities). Track inventorymaximize tax deductionsget tax savingstrack projects Web in a nonprofit’s chart of accounts, each account is identified in four ways: Here's how a functioning coa can help your organization. This is important for many reasons, including auditing and reporting (i.e., government tax filings). Web a nonprofit chart of accounts allows you to track your finances at a more granular level. 4/5 (41 reviews) In our last post, lists: Create a list of accounts. But the first two, number and name, determine the overall structure and organization of accounts and subaccounts. Web what is a nonprofit chart of accounts? Cash, accounts receivable, revenue, expenses etc). Web a nonprofit chart of accounts allows you to track your finances at a more granular level. Let’s dive in with an overview of what your nonprofit’s coa is and how it’s. A chart of accounts (coa) is a list of general accounts where each is. Track inventorymaximize tax deductionsget tax savingstrack projects Web in a nonprofit’s chart of accounts, each account is identified in four ways: Web in this guide, we’ll explore the basics of the nonprofit chart of accounts, including: But why should it matter to your nonprofit, and how will you create and maintain one? Web a chart of accounts (coa) is a. There are a variety of activities that your chart of accounts can inform, but we’ll look at two in more detail: It’s a series of line items, or accounts, that allows you to organize your accounting data. Because the coa compiles so much information, this important resource can be daunting to create and challenging to keep up with, especially if. Web the chart of accounts (coa) tracks your various ledgers and everything your nonprofit does financially. Compiling financial statements and preparing for audits. In our last post, lists: Web what is a nonprofit chart of accounts? A chart of accounts is a tool used by businesses and nonprofits to keep track of financial transactions, as shown in nonprofit financial statements. What is a chart of accounts? Web a non profit chart of accounts is used by a non profit organization, and is a list of the accounts found in the general ledger with an account code allocated to each account. 30% off clearance itemsprice match availableall the latestfree trial available Tips for maintaining your chart of accounts; Get all the. Every nonprofit organization has a unique coa that depends on your specific programs, revenue sources, and activities. The stronger the foundation, the stronger the building — the same holds true for the chart of accounts. Web the nonprofit chart of accounts should be split into statement of financial position and statement of activities sections, each of which is then subdivided. But the first two, number and name, determine the overall structure and organization of accounts and subaccounts. Because the coa compiles so much information, this important resource can be daunting to create and challenging to keep up with, especially if you don’t fully understand its usefulness.” visit the guide and example. What is a nonprofit chart of accounts? Web a. The pdf file available for download below, will help you to produce your own nonprofit chart of accounts template. It’s part of your accounting architecture. 4/5 (41 reviews) The stronger the foundation, the stronger the building — the same holds true for the chart of accounts. Compiling financial statements and preparing for audits. Web what is a chart of accounts anyway? Web the chart of accounts (or coa) is a numbered list that categorizes your financial activity into different accounts and subaccounts. It’s part of your accounting architecture. Here's how a functioning coa can help your organization. Web a nonprofit chart of accounts allows you to track your finances at a more granular. What is a chart of accounts? Web a chart of accounts is commonly numbered as follows: Web the nonprofit chart of accounts should be split into statement of financial position and statement of activities sections, each of which is then subdivided into groups (e.g. Statement of activities (profit and loss) revenue: Track inventorymaximize tax deductionsget tax savingstrack projects Manage volunteersincrease productivityconnect with donorslearn digital skills These line items pertain to your financial position (or statement of financial position) and to your financial activities (or statement of activities). A chart of accounts (coa) is a list of general accounts where each is broken down into categories to help nonprofit leaders monitor the financial position of an organization. A chart of accounts is a tool used by businesses and nonprofits to keep track of financial transactions, as shown in nonprofit financial statements. It’s part of your accounting architecture. There are a variety of activities that your chart of accounts can inform, but we’ll look at two in more detail: Create a list of accounts. Number, name, category type, and a short description. Web a nonprofit chart of accounts allows you to track your finances at a more granular level. 4/5 (41 reviews) The chart of accounts does not.A Sample Chart of Accounts for Nonprofit Organizations — Altruic Advisors

Nonprofit Chart Of Accounts

Nonprofit Chart of Accounts How to Get Started + Example

The Beginner’s Guide to Nonprofit Chart of Accounts

Grow Your Nonprofit Organization With A Good Chart of Accounts Help

Chart Of Accounts Nonprofit

Nonprofit Chart of Accounts Template Double Entry Bookkeeping

Chart Of Accounts For Non Profit

Sample Nonprofit Chart Of Accounts

Set Up a Nonprofit Chart of Accounts (Free Template) The Charity CFO

Proper Set Up Streamlines Financial Reporting, Safeguards Compliance, And Tracks Revenue And Expenses.

Web In This Guide, We’ll Explore The Basics Of The Nonprofit Chart Of Accounts, Including:

Web A Non Profit Chart Of Accounts Is Used By A Non Profit Organization, And Is A List Of The Accounts Found In The General Ledger With An Account Code Allocated To Each Account.

Web A Guide To Implementing A Chart Of Accounts, An Essential Tool For Nonprofits To Organize Finances And Ensure Accurate Reporting.

Related Post: