Credit Card Amortization Chart

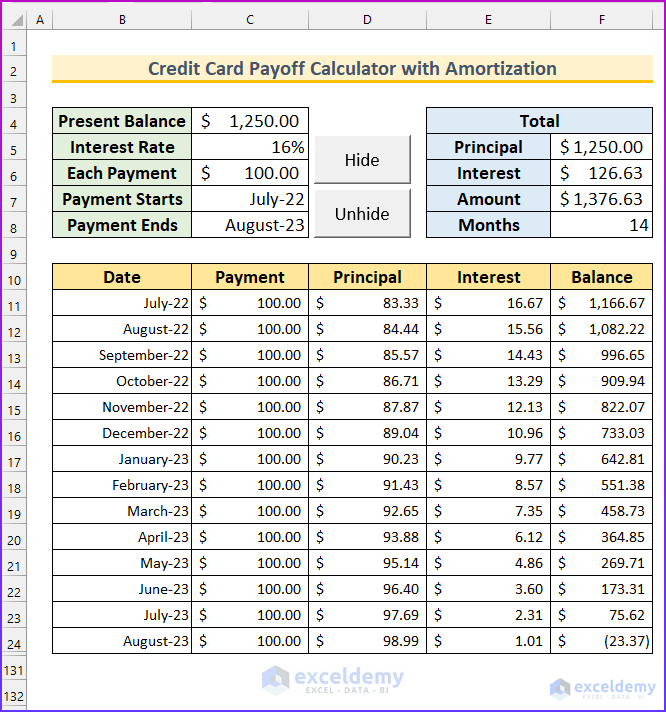

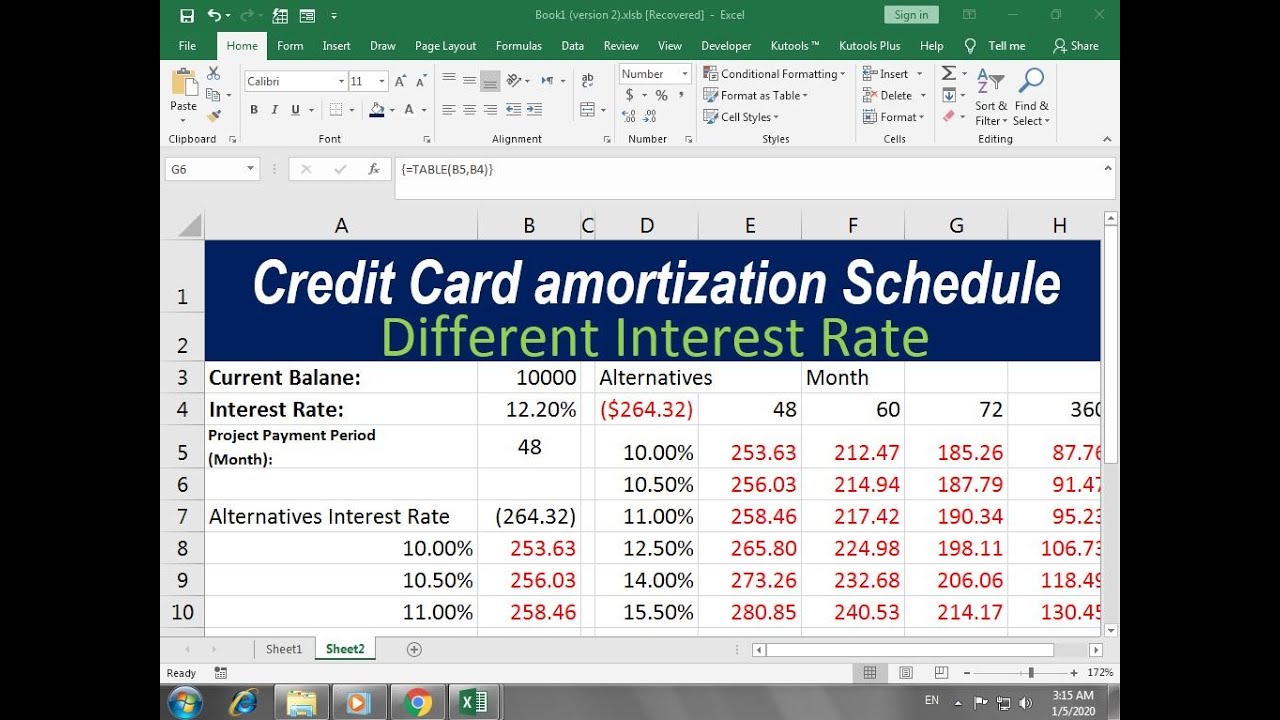

Credit Card Amortization Chart - Web the credit card calculator is a handy tool for analyzing the repayment of your credit card balance. Just input your current card balance along with the interest rate and your monthly payments. Web use the credit card interest calculator to get a credit card amortization schedule and see exactly how much interest you will be paying and how long it will take you to pay off your. Find your payoff date & total interest. You can set a specific monthly payment to see how long it will take. How do credit card payments work? Amortization is a loan repayment structure that entails scheduled, periodic, equal payments applied to the loan’s principal and interest. Web there’s no hard credit check required, and many plans won’t charge interest or fees, or hurt your credit scores, unless you miss a payment. Web the credit card payment calculator allows you to choose one of two payment methods: The american economy has held up well against. Web a credit card loan calculator that allows one to enter data for a new or existing credit card loan to determine one's payment. The credit card calculator has an amortization schedule that shows. Web credit card payoff calculator. This credit card interest calculator figures how much of. How do credit card payments work? Web our credit card calculator tool helps you understand the total interest paid on your debt and how your debt will amortize (be paid off) over time. Web credit card amortization calculator is used to calculate the monthly payment for your credit card debt. This calculator helps find the time it will take to pay off a balance or the amount necessary to pay it off within a certain time frame. Unlike a fixed mortgage or loan where the monthly payment is fixed.a credit card amortization schedule is different because you can make minimum payments or more and rack up more spending each month. With a balance of $8,483 and an average interest rate of 21.59%. Web with our credit card payoff calculator, it’s easy to get a handle on your debt. Just input your current card balance along with the interest rate and your monthly payments. Web credit card payoff calculator with amortization schedule to calculate how much faster you can payoff your credit card balance with extra payments and check how much you can.. Web this amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. With a balance of $8,483 and an average interest rate of 21.59%. Web to use the credit card payoff calculator at the bottom of this article, you’ll need to know your current balance, interest rate or annual. Web credit card payoff calculator. Web americans owe $1.13 trillion in revolving credit card debt as of the fourth quarter of 2023, according to the new york federal reserve’s 2023: Calculate months to payoff and total interest paid. Find your payoff date & total interest. Web the credit card calculator is a handy tool for analyzing the repayment of your. Web there’s no hard credit check required, and many plans won’t charge interest or fees, or hurt your credit scores, unless you miss a payment. This credit card interest calculator figures how much of. Web credit card payoff calculator with amortization schedule to calculate how much faster you can payoff your credit card balance with extra payments and check how. Web with our credit card payoff calculator, it’s easy to get a handle on your debt. Web americans owe $1.13 trillion in revolving credit card debt as of the fourth quarter of 2023, according to the new york federal reserve’s 2023: Web credit card amortization calculator is used to calculate the monthly payment for your credit card debt. Just input. One can enter an extra payment and a rate of. Web if you have a $5,000 balance on your credit card, you can use any online amortization calculator and input the credit card payment amount you want to make. Web credit card minimum payment calculator with amortization schedule to calculate the minimum monthly payment, the payoff date, and the total. Find your payoff date & total interest. One can enter an extra payment and a rate of. How to calculate credit card payments? Web there’s no hard credit check required, and many plans won’t charge interest or fees, or hurt your credit scores, unless you miss a payment. This credit card interest calculator figures how much of. Amortization is a loan repayment structure that entails scheduled, periodic, equal payments applied to the loan’s principal and interest. See our full list of calculators by topic. Web our credit card calculator tool helps you understand the total interest paid on your debt and how your debt will amortize (be paid off) over time. Just input your current card balance. One can enter an extra payment and a rate of. Web credit card interest calculator: Web our credit card calculator tool helps you understand the total interest paid on your debt and how your debt will amortize (be paid off) over time. Web credit card payoff calculator. How to calculate credit card payments? This calculator helps find the time it will take to pay off a balance or the amount necessary to pay it off within a certain time frame. Web credit card minimum payment calculator with amortization schedule to calculate the minimum monthly payment, the payoff date, and the total interest payment for your. Principal paid and your loan balance over the. Web credit card payoff calculator with amortization schedule to calculate how much faster you can payoff your credit card balance with extra payments and check how much you can. Web with our credit card payoff calculator, it’s easy to get a handle on your debt. Call nowhighest ranked companiesalways freecompare multiple options Web use the credit card interest calculator to get a credit card amortization schedule and see exactly how much interest you will be paying and how long it will take you to pay off your. Unlike a fixed mortgage or loan where the monthly payment is fixed.a credit card amortization schedule is different because you can make minimum payments or more and rack up more spending each month. Web free credit card payoff calculator for finding the best way to pay off multiple credit cards and estimating the length of time it would take. Web the credit card payoff calculator on myfin is the best tool which calculates when you will pay off your debt and helps you to plan your payments with a convenient. Web the credit card calculator is a handy tool for analyzing the repayment of your credit card balance. Web our amortization schedule calculator will show your payment breakdown of interest vs. Calculate months to payoff and total interest paid. Just input your current card balance along with the interest rate and your monthly payments. Plan a better futuredebt managementproud nonprofithomebuyer education How to use the credit card monthly payment. Web our credit card calculator tool helps you understand the total interest paid on your debt and how your debt will amortize (be paid off) over time. Web credit card minimum payment calculator with amortization schedule to calculate the minimum monthly payment, the payoff date, and the total interest payment for your. With a balance of $8,483 and an average interest rate of 21.59%.How to make a credit card amortization schedule excel maztrain

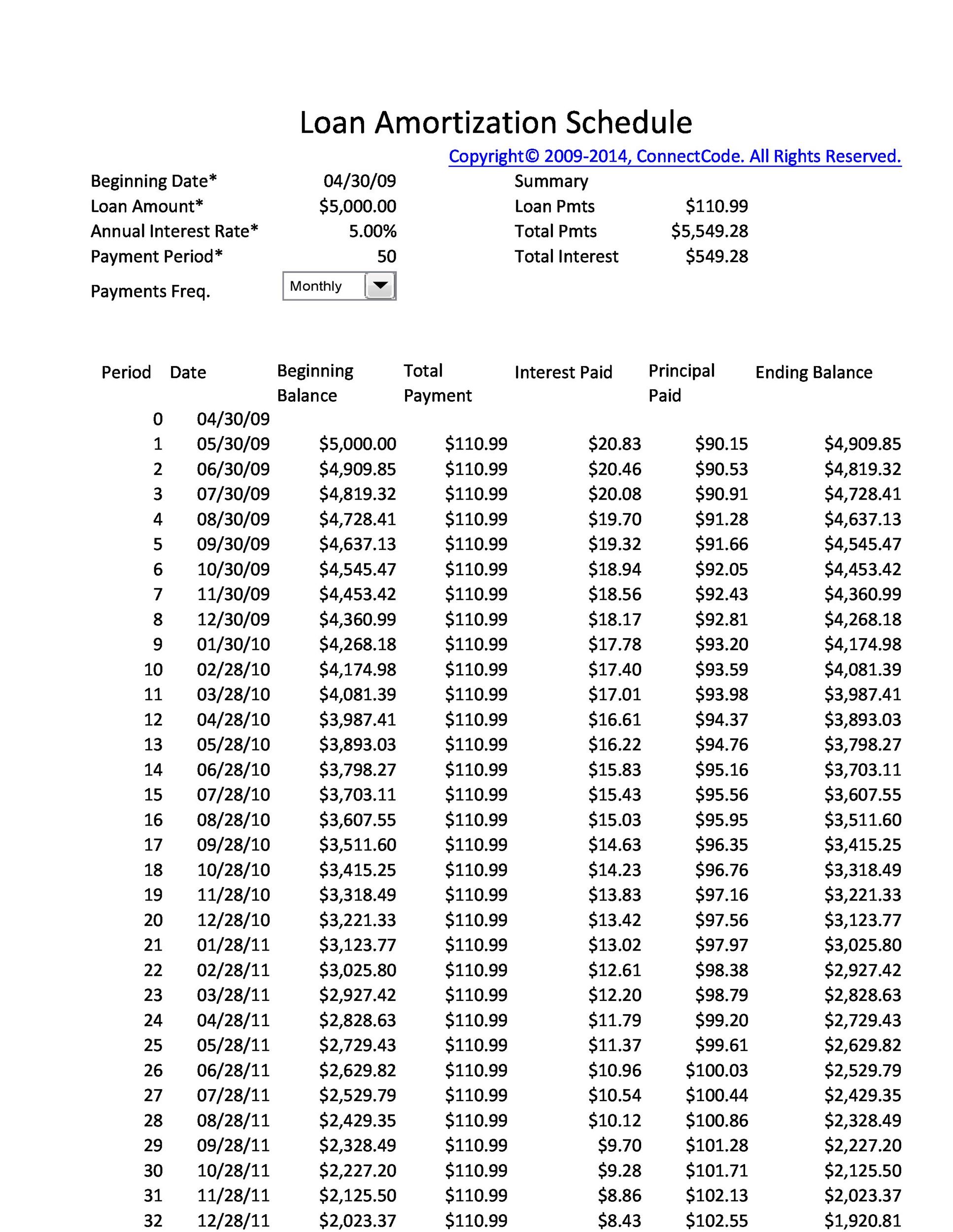

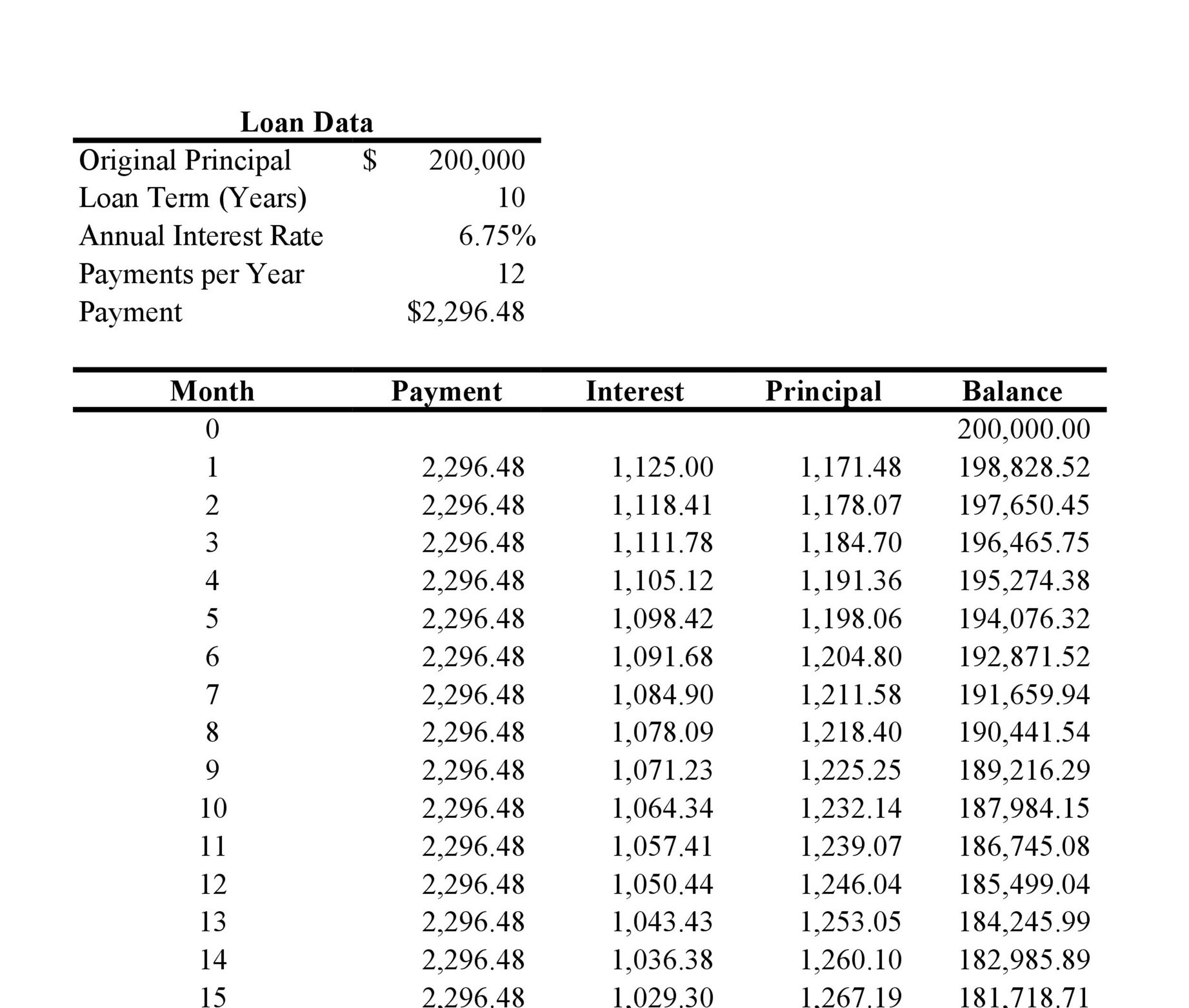

Printable Amortization Schedule With Extra Payments FreePrintable.me

Free 9 Sample Amortization Schedules In Excel vrogue.co

Free Printable Amortization Schedule Calculator Printable Templates

FREE 7+ Amortization Table Samples in Excel

How Do You Create An Amortization Schedule In Excel Printable Online

28 Tables to Calculate Loan Amortization Schedule (Excel) Template Lab

Make Credit Card Payoff Calculator with Amortization in Excel

how to make a credit card amortization schedule excel YouTube

28 Tables to Calculate Loan Amortization Schedule (Excel) ᐅ TemplateLab

First We Calculate The Payoff Date For.

Web To Use The Credit Card Payoff Calculator At The Bottom Of This Article, You’ll Need To Know Your Current Balance, Interest Rate Or Annual Percentage Rate (Apr) And.

Just Like A Mortgage Or A Loan, Credit Cards Have An Amortization Schedule.

Web There’s No Hard Credit Check Required, And Many Plans Won’t Charge Interest Or Fees, Or Hurt Your Credit Scores, Unless You Miss A Payment.

Related Post: