Dp1 Dp2 Dp3 Comparison Chart

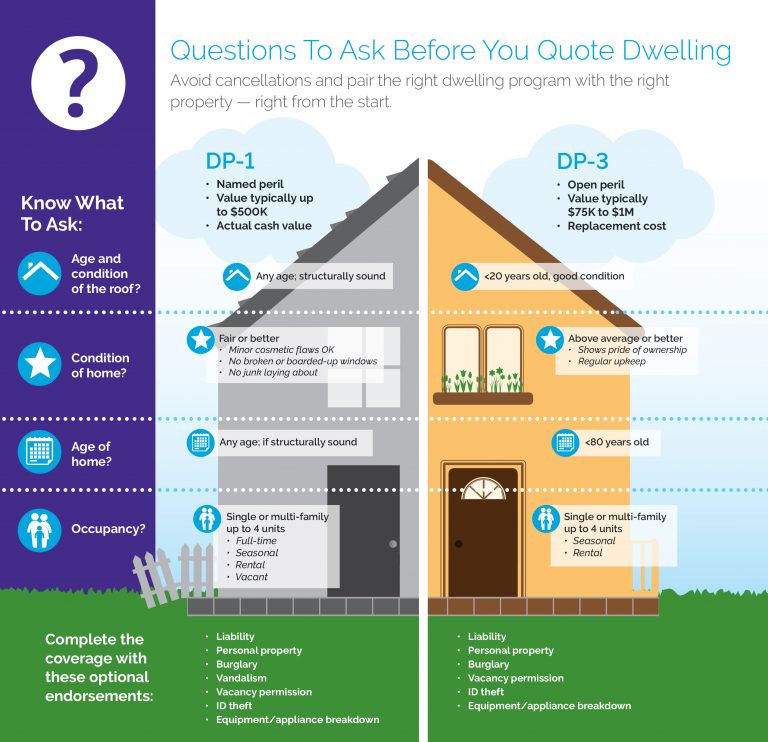

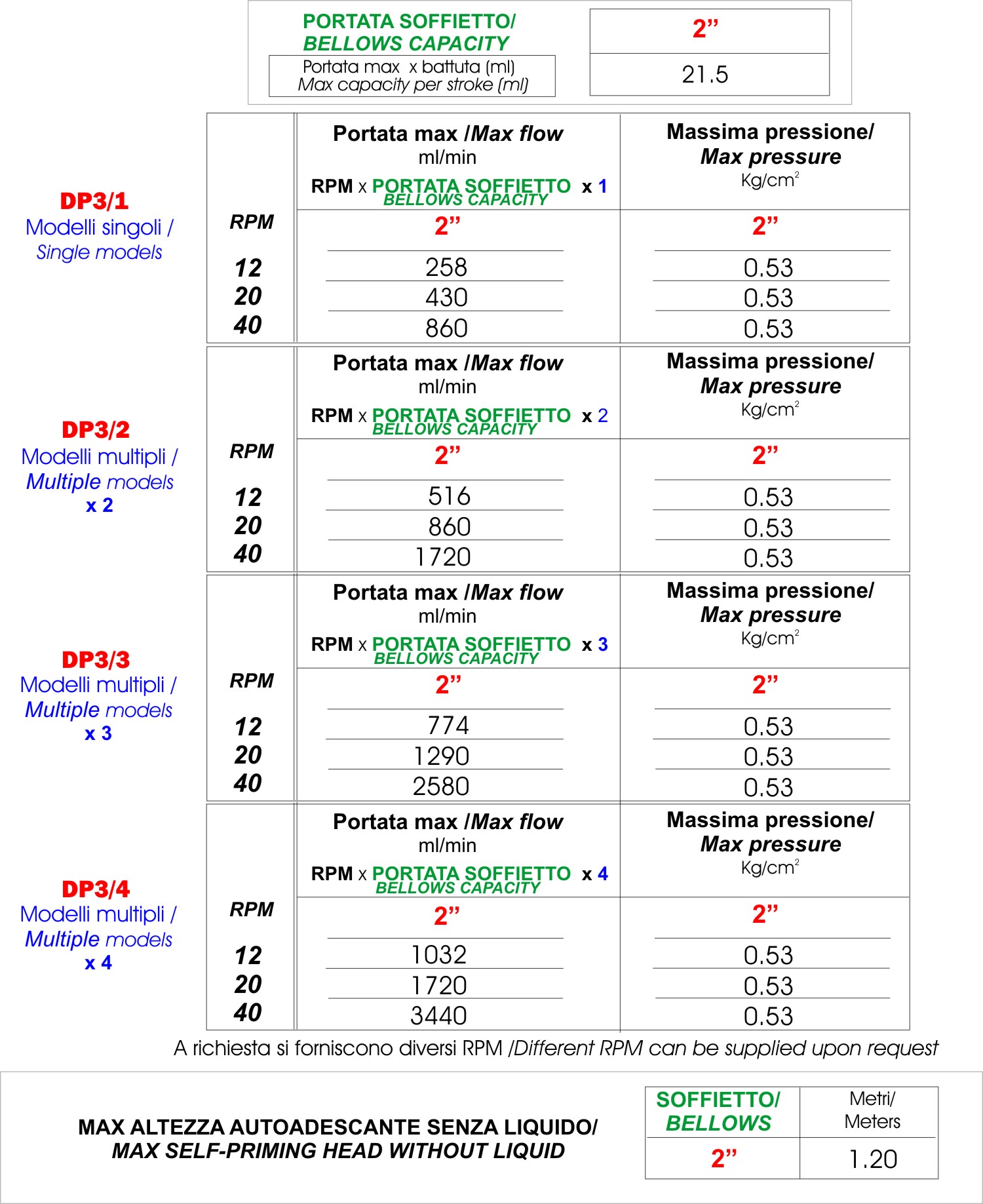

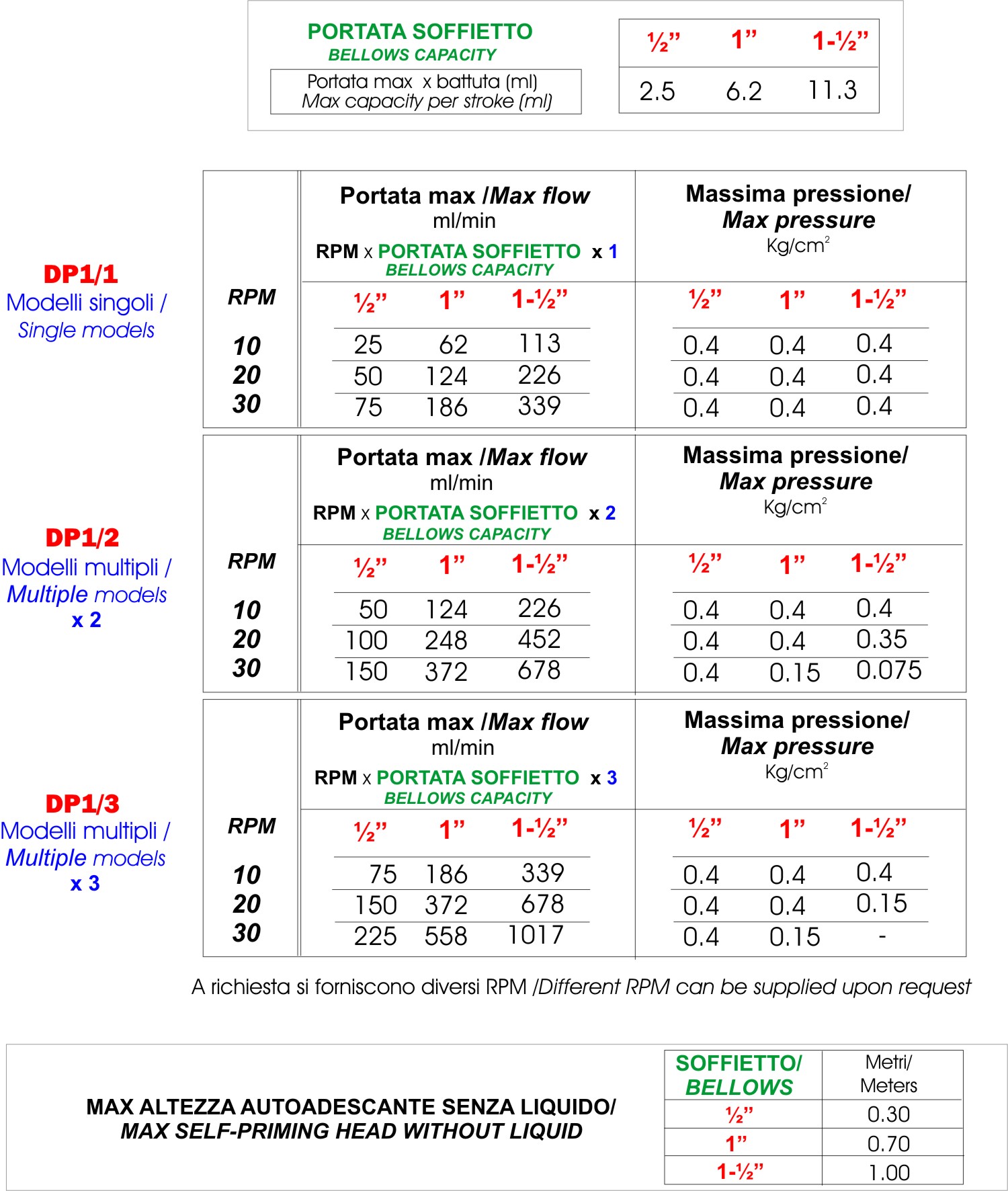

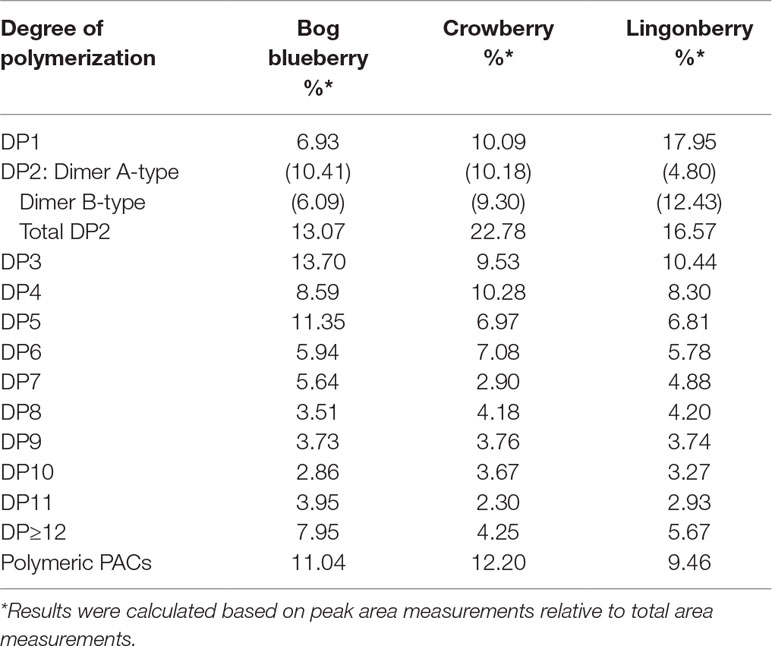

Dp1 Dp2 Dp3 Comparison Chart - Web compare the differences between dp1, dp2, and dp3 to determine which policy type you need for your property. The dp1 is used for vacant property insurance and offer's the minimum coverage amount while the dp3 is. Alternatively, there is the dp3, which is known as the. Web the premium difference between a dp1 and dp3 policy can vary significantly based on the insured property's value, location, age, and other risk factors. Many insurers don’t cover homes with roofs. Web a dp1 policy is a basic form of insurance for vacant homes and rental properties that is more limited than dp2 and dp3 policies. Web the three most common rental insurance policies are the dp1, dp2, and dp3. In this article, we will. Web dp1, dp2, and dp3 policies are commonly used for residential properties, but each one offers different levels of coverage and protection. Like dp1, the dp2 policy is also a named peril policy. Dp3 policies are most commonly for properties the owner rents to others. Web if you’re shopping for dwelling fire insurance, you may have come across the terms dp1 and dp3. It is a named peril policy, and. Web the biggest difference between dp3 and ho3 is the type of risk each covers. Obie offers quotes for all three and can help you secure. Web a dp3 policy is dwelling property insurance that’s customized to fit homes with older roofs or homes used as investment properties. Web a dp1 policy is a basic form of insurance for vacant homes and rental properties that is more limited than dp2 and dp3 policies. Web insurance companies offer several types of dwelling fire policies, including dp1, dp2, and dp3, which vary in the level of coverage they provide. The main difference is that it offers protection against more. Web apart from dp1, two other policies to consider are dp2 and dp3. It is a named peril policy, and. In this article, we will. Web compare the differences between dp1, dp2, and dp3 to determine which policy type you need for your property. The dp1 is used for vacant property insurance and offer's the minimum coverage amount while the dp3 is. Alternatively, there is the dp3, which is known as the. Web the premium difference between a dp1 and dp3 policy can vary significantly based on the insured property's value, location, age, and other risk factors. The levels build on each other, with each succeeding level having the abilities of the previous. Web the three most common rental insurance policies are the dp1, dp2, and dp3. Web one of the most. The main difference is that it offers protection against more. Dp3 policies are most commonly for properties the owner rents to others. Web the three most common rental insurance policies are the dp1, dp2, and dp3. Web if you’re shopping for dwelling fire insurance, you may have come across the terms dp1 and dp3. Web one of the most common. Web the biggest difference between dp3 and ho3 is the type of risk each covers. Web a spreadsheet that compares the coverage options and perils for different types of homeowners insurance policies, such as dp1, dp2, dp3, ho2, ho3, etc. The levels build on each other, with each succeeding level having the abilities of the previous. Web dp1, dp2, and. Like dp1, the dp2 policy is also a named peril policy. It is a named peril policy, and. Web if you’re shopping for dwelling fire insurance, you may have come across the terms dp1 and dp3. Web insurance companies offer several types of dwelling fire policies, including dp1, dp2, and dp3, which vary in the level of coverage they provide.. Alternatively, there is the dp3, which is known as the. Web compare the differences between dp1, dp2, and dp3 to determine which policy type you need for your property. Web one of the most common questions we get asked by our landlord clients is “what’s the difference in a dp1 basic policy and a dp3 special policy?” below, we have. Web the three most common rental insurance policies are the dp1, dp2, and dp3. Web apart from dp1, two other policies to consider are dp2 and dp3. Web the dp1 and dp3 are two types of dwelling fire policies. Web if you’re shopping for dwelling fire insurance, you may have come across the terms dp1 and dp3. The main difference. Many insurers don’t cover homes with roofs. In this article, we will. Web the premium difference between a dp1 and dp3 policy can vary significantly based on the insured property's value, location, age, and other risk factors. Web a spreadsheet that compares the coverage options and perils for different types of homeowners insurance policies, such as dp1, dp2, dp3, ho2,. Web the premium difference between a dp1 and dp3 policy can vary significantly based on the insured property's value, location, age, and other risk factors. In this article, we will. Covers more perils than a dp1, such as falling objects, freezing pipes, and theft, but is. Web the dp1 policy is typically the cheapest, but definitely the lowest coverage you. The dp1 is used for vacant property insurance and offer's the minimum coverage amount while the dp3 is. An ho3 policy is for owner. The levels build on each other, with each succeeding level having the abilities of the previous. The dp1 is the most basic landlord insurance policy, providing very bare bones coverage. These two types of policies offer. These two types of policies offer different levels of coverage, so it’s. Web a dp3 policy is dwelling property insurance that’s customized to fit homes with older roofs or homes used as investment properties. The levels build on each other, with each succeeding level having the abilities of the previous. Web a dp1 policy is a basic form of insurance for vacant homes and rental properties that is more limited than dp2 and dp3 policies. Web dp1, dp2, and dp3 policies are commonly used for residential properties, but each one offers different levels of coverage and protection. In this article, we will. The dp1 is used for vacant property insurance and offer's the minimum coverage amount while the dp3 is. Web apart from dp1, two other policies to consider are dp2 and dp3. An ho3 policy is for owner. Web the dp1 and dp3 are two types of dwelling fire policies. Web the premium difference between a dp1 and dp3 policy can vary significantly based on the insured property's value, location, age, and other risk factors. Dp3 policies are most commonly for properties the owner rents to others. The main difference is that it offers protection against more. Web the biggest difference between dp3 and ho3 is the type of risk each covers. Web a spreadsheet that compares the coverage options and perils for different types of homeowners insurance policies, such as dp1, dp2, dp3, ho2, ho3, etc. Covers more perils than a dp1, such as falling objects, freezing pipes, and theft, but is.Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

DP1 and DP3 comparison chart American Modern Insurance Agents

Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

DP1 vs. DP2 vs. DP3 Which Insurance Policy Fits Your Needs?

Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

Dp1 Dp2 Dp3 Comparison Chart A Visual Reference of Charts Chart Master

Dp1 Dp2 Dp3 Insurance Comparison Chart Best Picture Of Chart

Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

DP1 vs. DP2 vs. DP3 Which Insurance Policy Fits Your Needs?

DP1 vs. DP2 vs. DP3 Which Insurance Policy Fits Your Needs?

Web Compare The Differences Between Dp1, Dp2, And Dp3 To Determine Which Policy Type You Need For Your Property.

Web If You’re Shopping For Dwelling Fire Insurance, You May Have Come Across The Terms Dp1 And Dp3.

Web Insurance Companies Offer Several Types Of Dwelling Fire Policies, Including Dp1, Dp2, And Dp3, Which Vary In The Level Of Coverage They Provide.

Many Insurers Don’t Cover Homes With Roofs.

Related Post:

.png)