Real Estate Cycle Chart

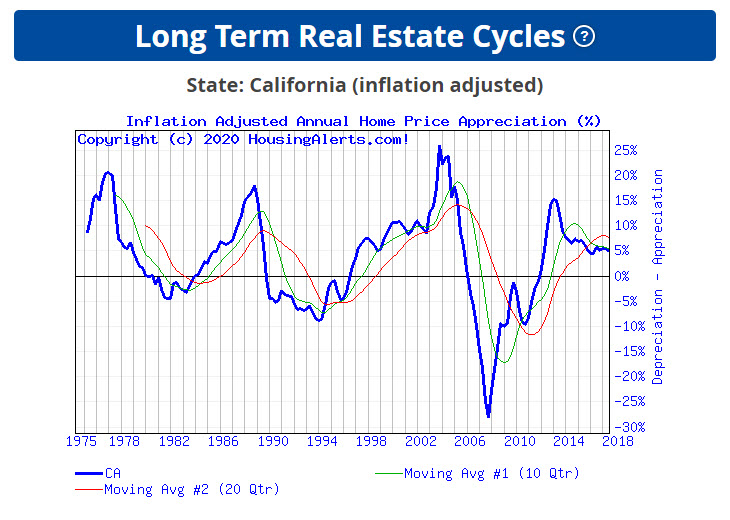

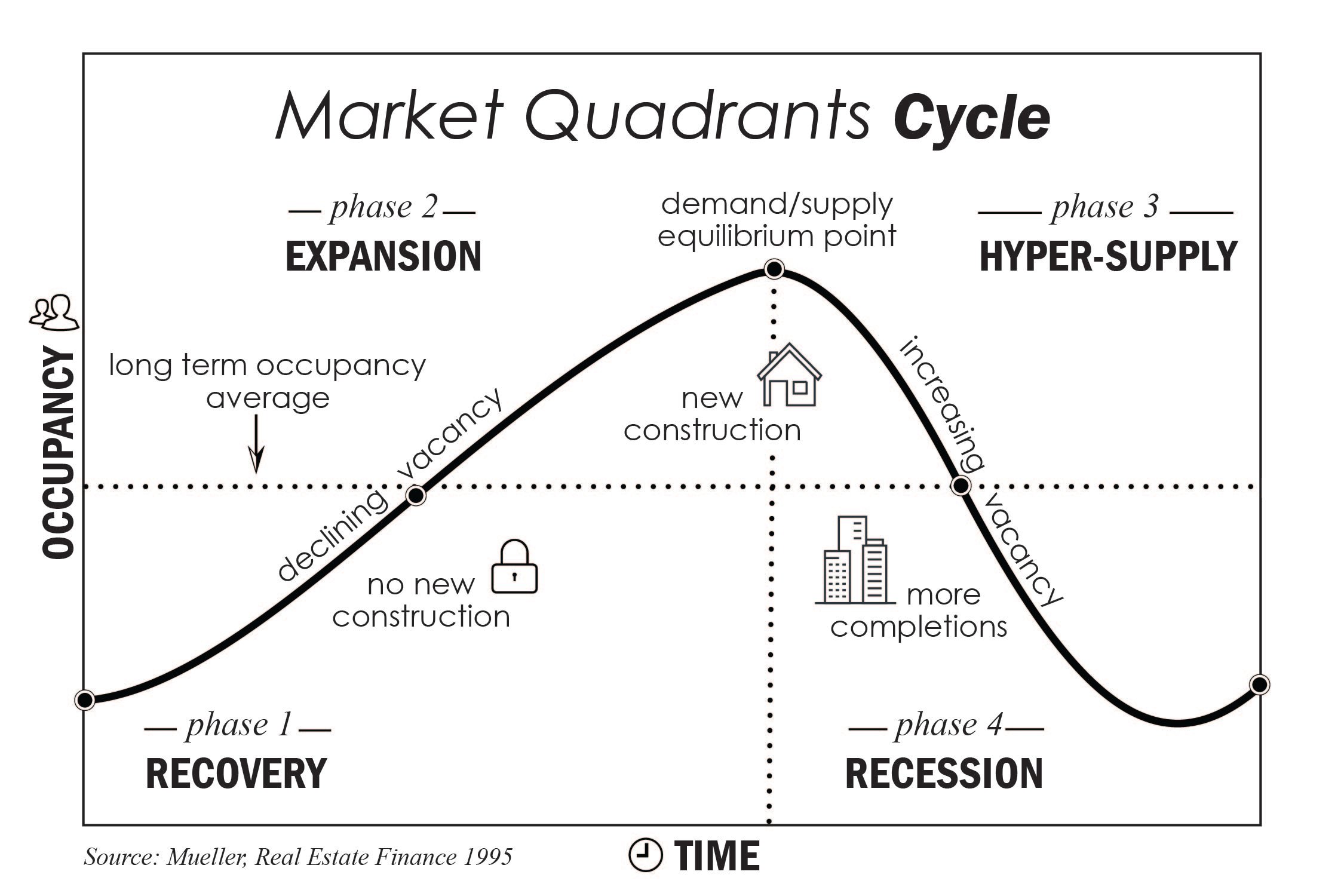

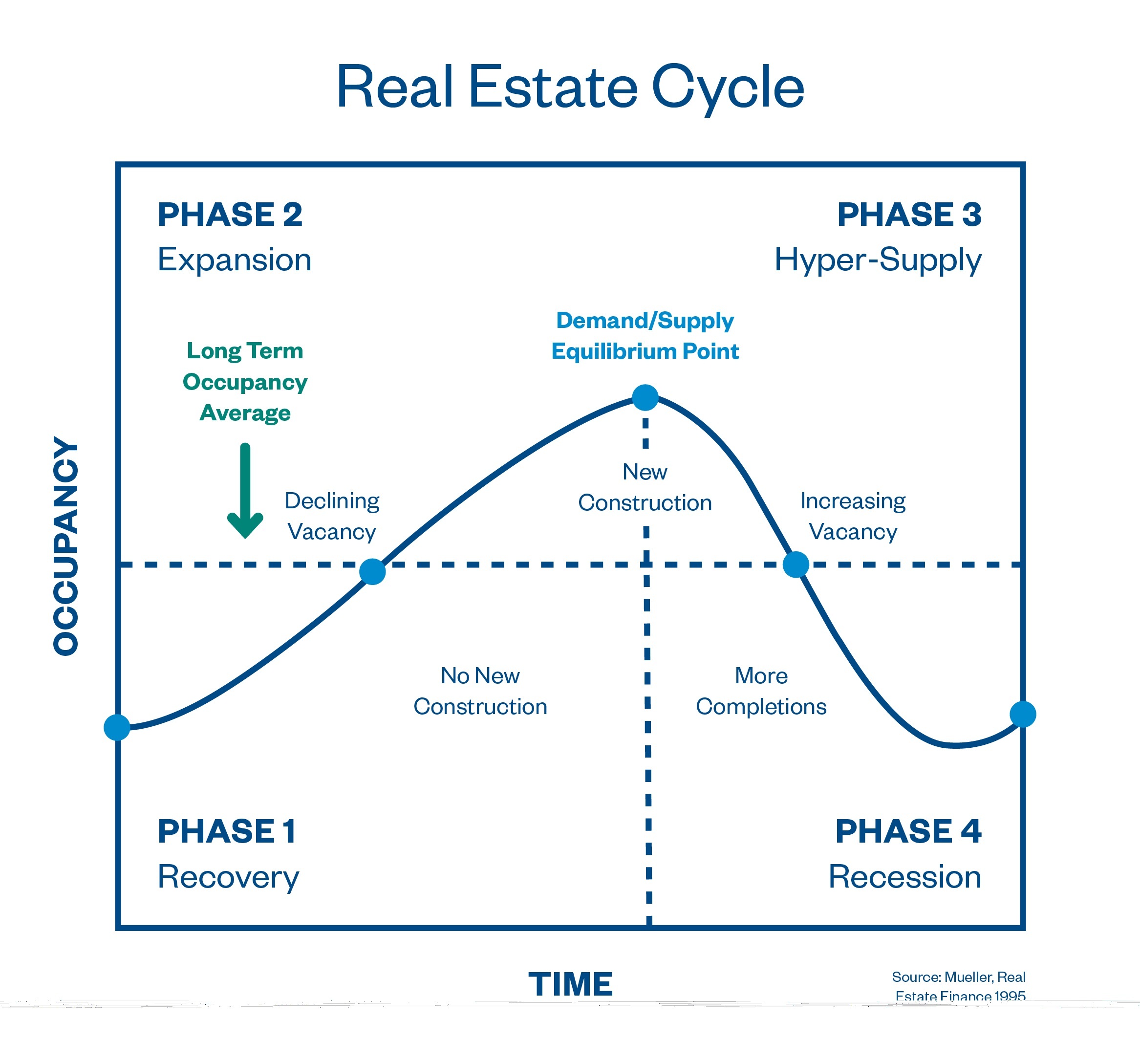

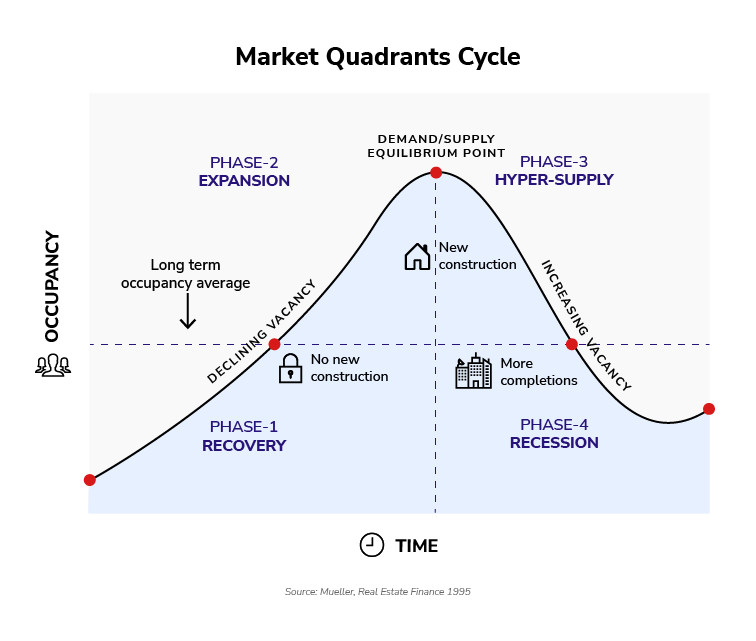

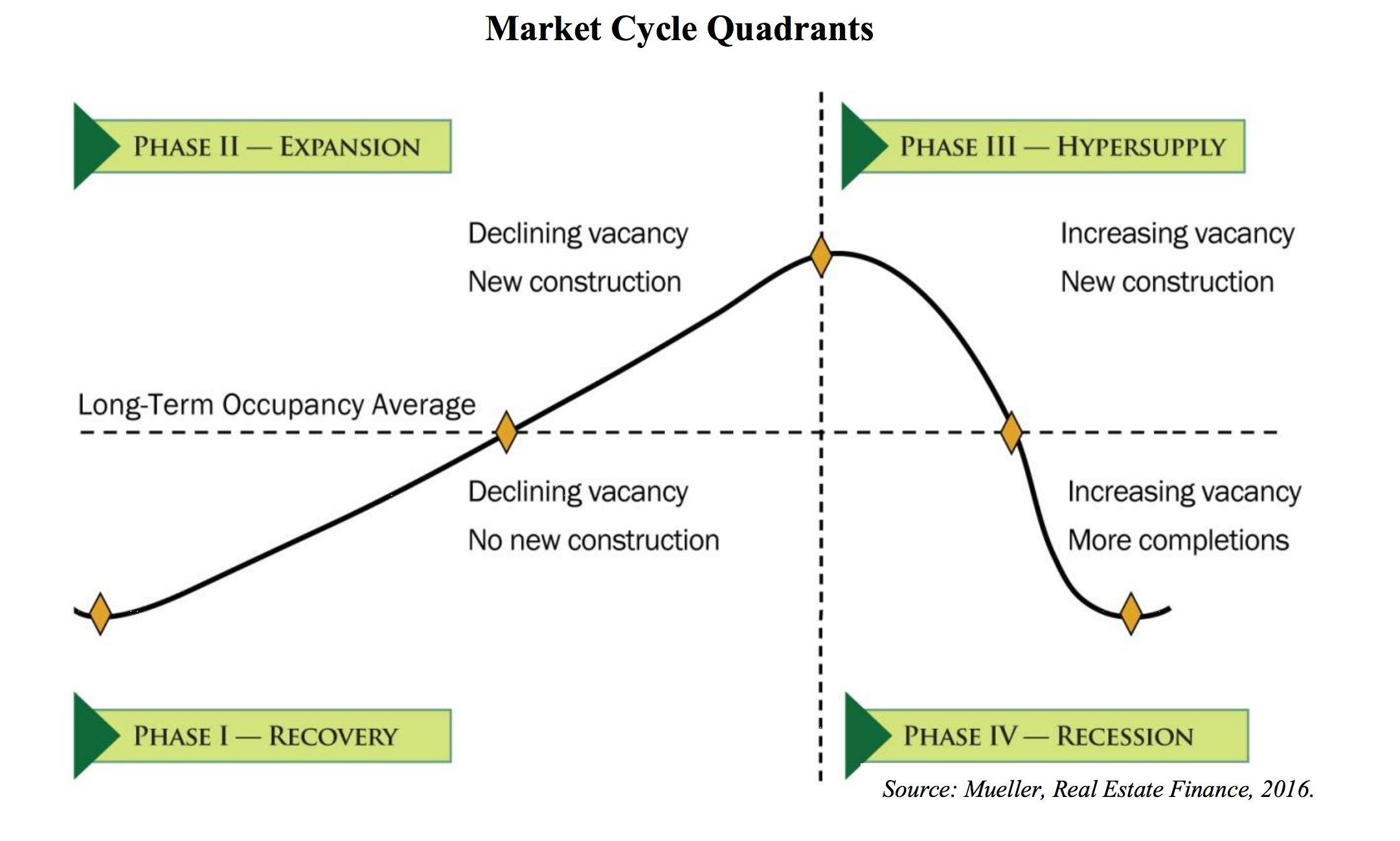

Real Estate Cycle Chart - These phases are characterized by certain indicators that can be used to adjust a. One of the most common questions we get today is about our positioning in the global listed real estate cycle. Real estate cycles can be separated into four distinct phases based upon the rate of change in both demand and supply. Web learn about the ins and outs of the real estate cycle and how to make smart investment decisions. Web florida republicans left their national convention convinced former president donald trump will return to the presidency, but uncertain about what the future holds for gov. The chart below shows these four phases and how each one impacts new construction and vacancy rates. Web nonetheless, a typical real estate cycle consists of four different phases, namely: Last updated on july 1, 2022. While i generally agree with this, i break market cycles down into eight stages to make them easier to follow. Read ratings & reviewsdeals of the dayshop best sellersshop our huge selection Web florida republicans left their national convention convinced former president donald trump will return to the presidency, but uncertain about what the future holds for gov. Six to seven years are up and the other six to seven years are flat or down markets. Home values in florida rose by 66.3% in the last 5 years. Last updated on july 1, 2022. Web gain an understanding of the four stages of the real estate cycle and discover what you need to know in order to get the most out of your property investments. So, florida’s housing market is strong, if not bullish. As you can see, the 18 year cycle theory looks great until that huge gap between 1925 and 1973. Before i explain the four phases of the real estate market cycle, let’s discuss the basics of the chart. Web commercial and residential real estate follows a cyclical pattern, usually closely linked to local and national economic trends. Here are 19 housing market charts that will help you understand the market as it. Each stage is characterized by different market conditions and indicators. Read ratings & reviewsdeals of the dayshop best sellersshop our huge selection Web the real estate cycle comprises four main phases: Web learn more about the four different phases of the commercial real estate cycle and why each is important to analyze when investing. The chart below shows these four. During these same years of. Web volatility in real estate market cycles. Each stage is characterized by different market conditions and indicators. Each peak is followed by a decline that coincides with an economic recession. One of the most common questions we get today is about our positioning in the global listed real estate cycle. This cyclical pattern is called the “real estate cycle” and includes four main phases. As you can see, the 18 year cycle theory looks great until that huge gap between 1925 and 1973. One of the most common questions we get today is about our positioning in the global listed real estate cycle. Web the real estate cycle comprises four. Orlando has seen annual listing prices rise by 20% over the past year, making the metro one of at least 5 areas that saw an annual listing price of 18% or more, according to usa today. Each stage is characterized by different market conditions and indicators. Real estate cycles can be separated into four distinct phases based upon the rate. Home values in florida rose by 66.3% in the last 5 years. Identify trends, capitalize on opportunities, and mitigate risks effectively. Rent is $2,054 in june, up 0.5% month over month. Web the real estate market cycle consists of 4 phases, which are important for real estate investors to bear in mind on their journey to creating wealth. Web nonetheless,. Web learn about the ins and outs of the real estate cycle and how to make smart investment decisions. Web the real estate market cycle consists of 4 phases, which are important for real estate investors to bear in mind on their journey to creating wealth. The four phases include recovery, expansion, hyper supply and recession. The recovery phase is. Web the real estate cycle is typically divided into four distinct stages: Home values in florida rose by 66.3% in the last 5 years. Web volatility in real estate market cycles. Web here is a chart showing the cycle through 2007: Remember, though, that hoyt discovered his theory in the 30's, and at that point the 18 year cycle was. It’s split into four economic phases, which directly indicate market health. Web the real estate cycle is typically divided into four distinct stages: Recovery, expansion, hyper supply, and recession. Web this data helps show why the housing market feels so different than it did just a few years ago. The recovery phase is the first stage of the real estate. The four phases include recovery, expansion, hyper supply and recession. 5/5 (1,407 reviews) Such a modest dip signifies a stable demand: Occupancy is the difference between total supply (including newly Remember, though, that hoyt discovered his theory in the 30's, and at that point the 18 year cycle was nearly flawless. Web learn about the ins and outs of the real estate cycle and how to make smart investment decisions. Web the nws highlights a 50% chance of scattered showers and thunderstorms after 11 am, with new rainfall amounts forecasted to be less than a tenth of an inch, barring heavier quantities in potential. Home sales increased by 0.9% in january. Orlando has seen annual listing prices rise by 20% over the past year, making the metro one of at least 5 areas that saw an annual listing price of 18% or more, according to usa today. Web chart the phases of the real estate cycle and its effects on property investments. Web the real estate cycle, also called the property market cycle, is a pattern that represents the economic changes within the housing industry. These stages are not equal, and they are. Each peak is followed by a decline that coincides with an economic recession. Web learn about the ins and outs of the real estate cycle and how to make smart investment decisions. Web gain an understanding of the four stages of the real estate cycle and discover what you need to know in order to get the most out of your property investments. Web nonetheless, a typical real estate cycle consists of four different phases, namely: Web there are four phases in the cycle of real estate, and they look like this: It’s split into four economic phases, which directly indicate market health. Web learn more about the four different phases of the commercial real estate cycle and why each is important to analyze when investing. Recovery is typically the most difficult phase to identify. As you can see, the 18 year cycle theory looks great until that huge gap between 1925 and 1973. Rent is $2,054 in june, up 0.5% month over month. So, florida’s housing market is strong, if not bullish. Here are 19 housing market charts that will help you understand the market as it.REAL ESTATE CYCLES Tampa Commercial Real Estate

The Basics Of Real Estate Cycle Charts By Housing Alerts

The Four Stages of the Real Estate Cycle Ahead June 2020 Monthly

How to Determine Where We Are in the Real Estate Market Cycle CleanCut

Real Estate The Peak Is Here Armstrong Economics

Understanding Real Estate Cycles

The Real Estate Cycle (And How To Find The Next Investment)

Real Estate Cycle Stages

The Four Phases of the Real Estate Cycle CrowdStreet

The 4 Phases of the Real Estate Cycle Explained Willowdale Equity

During These Same Years Of.

Web The Real Estate Cycle Is Typically Divided Into Four Distinct Stages:

Jobs Lead To An Increase In Real Estate Prices And Demand For Residential Rental Units.

Real Estate Cycles Can Be Separated Into Four Distinct Phases Based Upon The Rate Of Change In Both Demand And Supply.

Related Post: