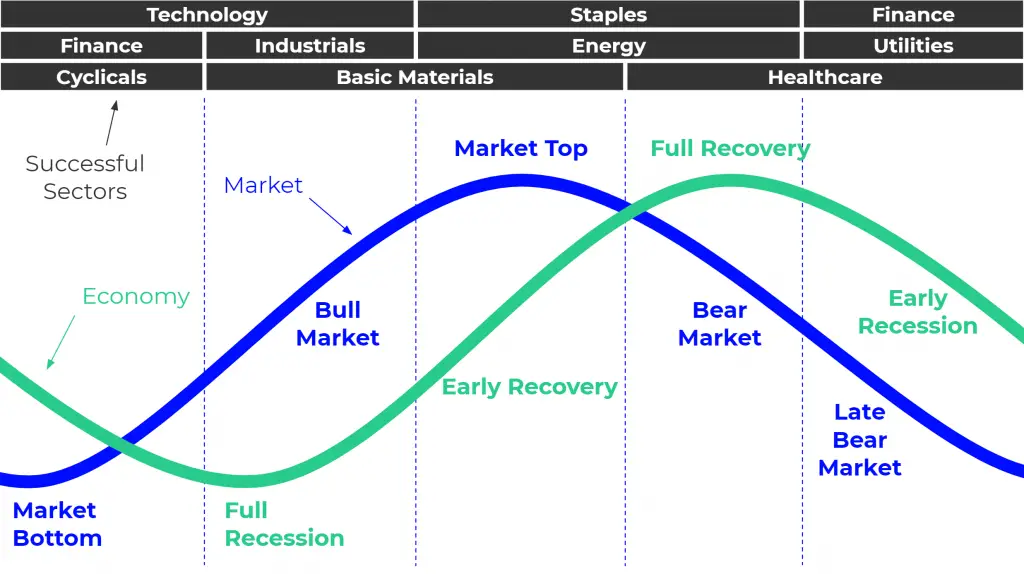

Sector Rotation Chart

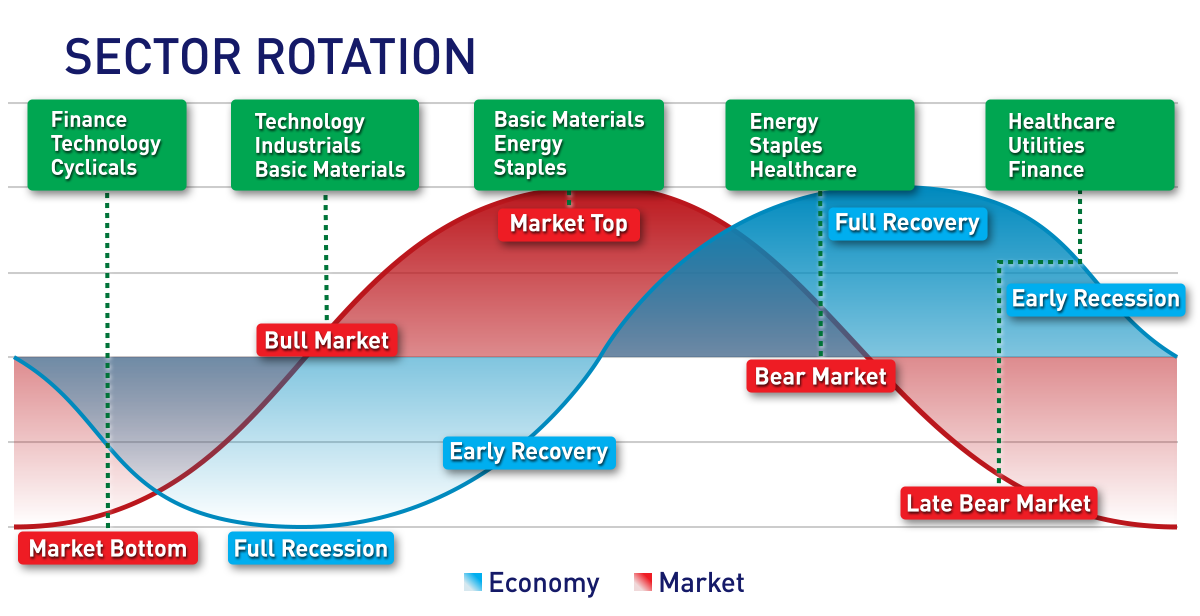

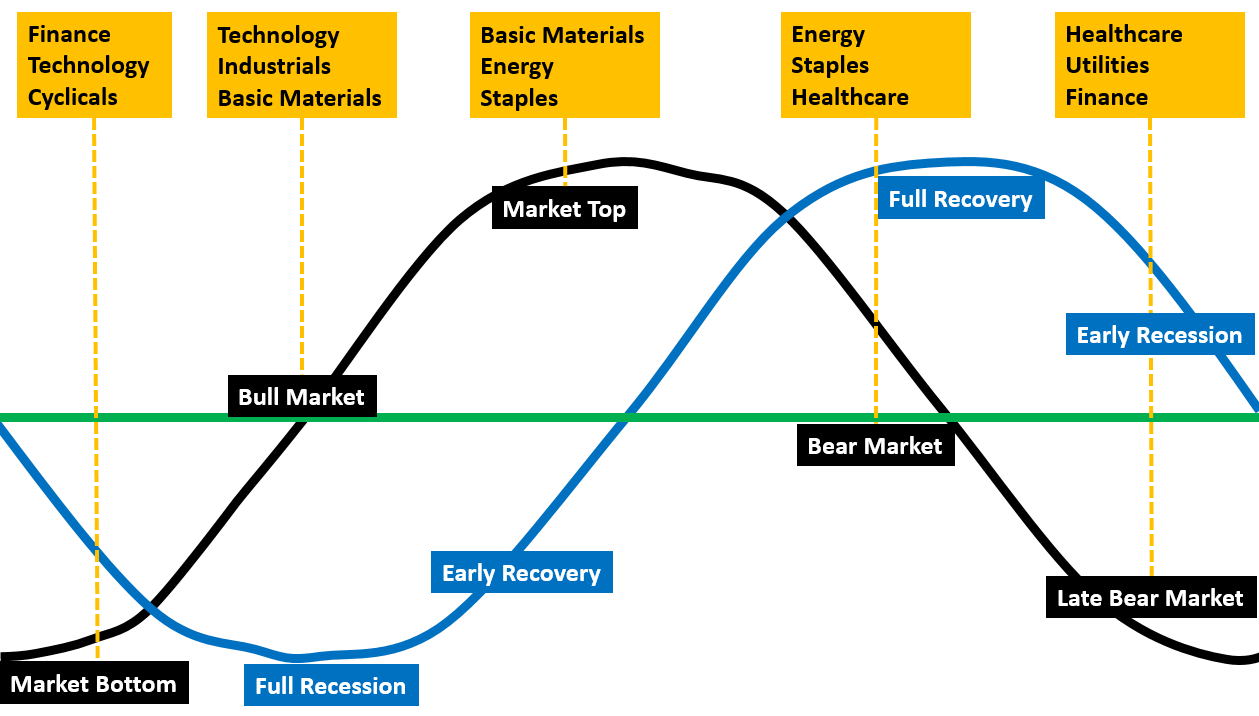

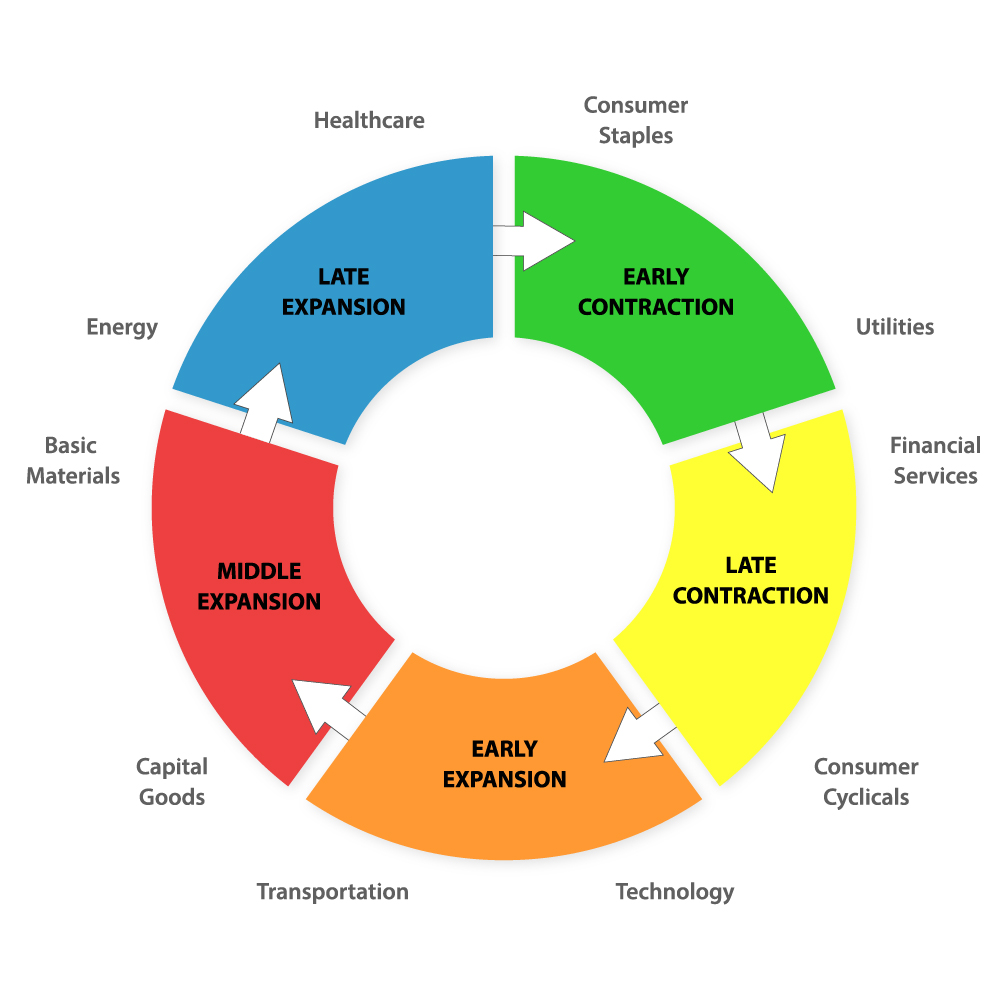

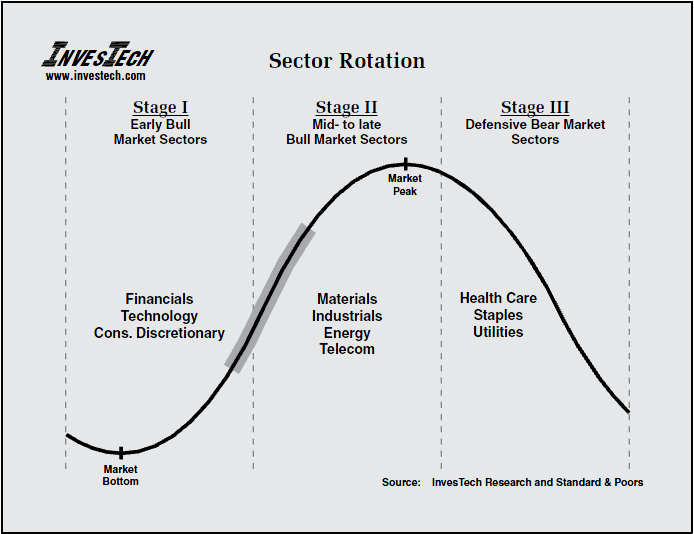

Sector Rotation Chart - Web the sector rotation model (from sam stovall's guide to sector rotation) is one of those models that i like to track. These indicators include price momentum, economic data, and market sentiment, each providing insights for strategic investment decisions. Web sticking with the sector rotation idea, consumer staples outperformed in both hong kong and mainland china, gaining +2.08% and +2.35% on chatter that a new consumption tax won’t include liquor. Web sector rotation is the movement of money in the stock market from one industry to another as investors anticipate the next stage of the economic cycle. Web the sector rotation hedging strategy with volatility index is a comprehensive trading indicator developed to optimally leverage the s&p500 volatility index. Web get automatic alerts—and a head start on your sector rotation game plan—when an equity or economic indicator reaches certain levels, including price, moving averages, rsi, and much more. The cboe volatility index vix rose to 16.52 on friday, finishing the week 32.6% higher, according to factset data. Web sector rotation strategies may help you align your portfolio with your market outlook and the different phases of the business cycle. You can see that basic industry (materials) and energy are late cycle leaders. Web rrg ® charts show you the relative strength and momentum for a group of stocks. Web sector rotation strategies may help you align your portfolio with your market outlook and the different phases of the business cycle. Web sector rotation is the movement of money in the stock market from one industry to another as investors anticipate the next stage of the economic cycle. Web get automatic alerts—and a head start on your sector rotation game plan—when an equity or economic indicator reaches certain levels, including price, moving averages, rsi, and much more. Web get automatic alerts—and a head start on your sector rotation game plan—when an equity or economic indicator reaches certain levels, including price, moving averages, rsi, and much more. As relative momentum fades, they typically move into the yellow weakening quadrant. Web sector rotation is an investment strategy that involves reallocating assets among various sectors of the economy to capitalize on the performance of different industries during different phases of the economic cycle. The loss of service disrupted business operations for many airlines, banks. Web the index rotates between eleven u.s. Investors can use it to. Web the sector rotation hedging strategy with volatility index is a comprehensive trading indicator developed to optimally leverage the s&p500 volatility index. Web the relative rotation graph (rrg) is a sophisticated tool in technical analysis to help investors decide which sectors, individual stocks, and other assets to pursue. Web sector rotation is an investment strategy that involves reallocating assets among various sectors of the economy to capitalize on the performance of different industries during different phases of the economic cycle. Web drill. Stocks with strong relative strength and momentum appear in the green leading quadrant. These indicators include price momentum, economic data, and market sentiment, each providing insights for strategic investment decisions. You can see that basic industry (materials) and energy are late cycle leaders. The graph at the top shows the theoretical flow of expected outperformance as it flows through the. Web visualize sector rotation data to help you find the leading stocks. It is designed to switch between distinct etf sectors, strategically hedging to moderate risk exposure during harsh market volatility. Web sector rotation strategies may help you align your portfolio with your market outlook and the different phases of the business cycle. Web investors utilize sector rotation indicators to. Web sector rotation refers to the phenomena where money flows from one sector to another due to a variety of reasons, both fundamental, and technical. Web relative rotation graphs, or rrgs are a unique visualization tool to show the cyclical rotation of markets (sectors) around a benchmark. Investors can use it to. The cboe volatility index vix rose to 16.52. Web in this week's episode of sector spotlight, i reviewed the current position of markets (sector rotation) in combination with the theoretical framework provided by the sector rotation model (sam stovall). Web the relative rotation graph (rrg) is a sophisticated tool in technical analysis to help investors decide which sectors, individual stocks, and other assets to pursue. Web sticking with. The cboe volatility index vix rose to 16.52 on friday, finishing the week 32.6% higher, according to factset data. Investors can use it to. Web in this week's episode of sector spotlight, i reviewed the current position of markets (sector rotation) in combination with the theoretical framework provided by the sector rotation model (sam stovall). Always stay ahead of the. Web relative rotation graphs, or rrgs are a unique visualization tool to show the cyclical rotation of markets (sectors) around a benchmark. The cboe volatility index vix rose to 16.52 on friday, finishing the week 32.6% higher, according to factset data. Web the sector rotation model (from sam stovall's guide to sector rotation) is one of those models that i. It is designed to switch between distinct etf sectors, strategically hedging to moderate risk exposure during harsh market volatility. As relative momentum fades, they typically move into the yellow weakening quadrant. Web visualize sector rotation data to help you find the leading stocks. Web the sector rotation hedging strategy with volatility index is a comprehensive trading indicator developed to optimally. Web the index rotates between eleven u.s. Web the sector rotation hedging strategy with volatility index is a comprehensive trading indicator developed to optimally leverage the s&p500 volatility index. Web relative rotation graphs, or rrgs are a unique visualization tool to show the cyclical rotation of markets (sectors) around a benchmark. Web visualize sector rotation data to help you find. Web sticking with the sector rotation idea, consumer staples outperformed in both hong kong and mainland china, gaining +2.08% and +2.35% on chatter that a new consumption tax won’t include liquor. Investors can use it to. All assets automatically update with the latest data, making for effortless creation of communication collateral. Web chart 1 is a visual representation of how. Web sticking with the sector rotation idea, consumer staples outperformed in both hong kong and mainland china, gaining +2.08% and +2.35% on chatter that a new consumption tax won’t include liquor. You can see that basic industry (materials) and energy are late cycle leaders. Web sector rotation is the movement of money in the stock market from one industry to another as investors anticipate the next stage of the economic cycle. An example of sector rotation can be money flowing from the real estate sector to the technology sector in case the real estate market becomes significantly overvalued, and starts. All assets automatically update with the latest data, making for effortless creation of communication collateral. Web the relative rotation graph (rrg) is a sophisticated tool in technical analysis to help investors decide which sectors, individual stocks, and other assets to pursue. Web an program update from cybersecurity firm crowdstrike early friday triggered major it outages worldwide. The cboe volatility index vix rose to 16.52 on friday, finishing the week 32.6% higher, according to factset data. Web rrg ® charts show you the relative strength and momentum for a group of stocks. Web sector rotation analysis attempts to link current strengths and weaknesses in the stock market with the general business cycle based on the relative performance of the eleven s&p sector spdr etfs. Web relative rotation graphs, or rrgs are a unique visualization tool to show the cyclical rotation of markets (sectors) around a benchmark. Always stay ahead of the curve by investing in strong performers and avoid laggers. It is designed to switch between distinct etf sectors, strategically hedging to moderate risk exposure during harsh market volatility. Dow futures added 11 points, or 0.03%, shortly after 6 p.m. Web get automatic alerts—and a head start on your sector rotation game plan—when an equity or economic indicator reaches certain levels, including price, moving averages, rsi, and much more. Investors can use it to.Mind in Focus . World

Trading Correlation Manager Seasonal And Sector Rotation. The Distant

Sector Rotation and the Stock Market Cycle The Big Picture

Sector Rotation PatternsWizard

Sector Rotation Analysis [ChartSchool]

Use the Correlation Between the Economy & Stock Market to Your Advantage

Stock Market Sector Rotation Strategy and How to Profit using it.

Sector Rotation Guides iSquare Intelligence

Sector Rotation Strategy Can it Outperform The Market?

5/24 MWL Recap Sector Rotation Chart Breakouts! Turning Point

Web Chart 1 Is A Visual Representation Of How That Happens.

Web Drill Down Into The Current And Past Performance Of The Major Us Market Sectors, Their Industry Indexes And The Individual Stocks That Constitute Those Groups.

Web The Sector Rotation Hedging Strategy With Volatility Index Is A Comprehensive Trading Indicator Developed To Optimally Leverage The S&P500 Volatility Index.

Web Stock Futures Were Little Changed On Tuesday Night.

Related Post:

![Sector Rotation Analysis [ChartSchool]](https://school.stockcharts.com/lib/exe/fetch.php?media=market_analysis:sector_rotation_analysis:sectorcycle.png)